Profit and Loss Property Investment

Jakarta - Making money from property assets can be the dream of many people. But, you need to understand first the pros and cons of investing in the property sector.

Quoted from Aesia, Sunday (31/07/2023), there are opportunities and challenges that need to be your attention so that you are not surprised when you are faced with risks when investing in property.

By knowing the investment opportunities and challenges in this sector, you can also set a better strategy so that the profits you generate can be maximized.

Profit Property Investment

Transparent and Scalable

Property investment has advantages that are different from other investments. This investment is physically transparent so that the results are clearly visible. In addition, we can control more as holders of property investments than we do with other investments such as stocks and cryptocurrencies

Excess income

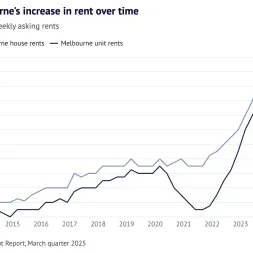

By investing in property, your income has the potential to be more than the instruments you invest. Reporting from On Property (onproperty.com.au), financial cash flow can run smoothly with you leasing assets to consumers and the result of this leasing is that your income will increase.

Minimal Risk

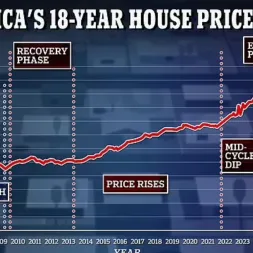

For beginners who are just starting to invest with large expenditures, property investment can be a low-risk option because the value of instrument flows in property is not sensitive and lower than investments such as stocks or crypto.

Stable market

Property investment has a stable flow and is not tight. According to Loan Market, this investment model has the potential to return on investment and is easier for investors.

Property Investment Losses

Apart from opportunities, property investment will still have challenges that must be faced during the course of this investment. So that this challenge also needs to be considered so that you can manage the process and risks in future plans. Therefore, the challenges that have the potential to occur and must be faced can be seen from the following list.

Big Capital

Starting a property investment even though it has a high opportunity and low risk, the capital prepared is large enough to own the property you want. It is possible that the property facilities obtained are inversely proportional to the capital you spend, even with a strategy and a large property value for the capital issued.

Expensive Treatment

Property maintenance costs require quite a large amount of capital because the shape of the property must still look attractive and have long-lasting properties such as leak resistance, no termites, and have an environment that attracts consumers.

Hard to Sell

If you are just starting to invest in property, don't expect to get occupants right away because the investment process is quite slow and quite difficult in marketing, when compared to stocks or crypto. Therefore, if you want liquidity quickly, such as an emergency fund need, then there is a possibility that the property's valuation can be lower than market quality.

https://www.detik.com/properti/tips-dan-panduan/d-6851831/untung-rugi-investasi-properti

Quoted from Aesia, Sunday (31/07/2023), there are opportunities and challenges that need to be your attention so that you are not surprised when you are faced with risks when investing in property.

By knowing the investment opportunities and challenges in this sector, you can also set a better strategy so that the profits you generate can be maximized.

Profit Property Investment

Transparent and Scalable

Property investment has advantages that are different from other investments. This investment is physically transparent so that the results are clearly visible. In addition, we can control more as holders of property investments than we do with other investments such as stocks and cryptocurrencies

Excess income

By investing in property, your income has the potential to be more than the instruments you invest. Reporting from On Property (onproperty.com.au), financial cash flow can run smoothly with you leasing assets to consumers and the result of this leasing is that your income will increase.

Minimal Risk

For beginners who are just starting to invest with large expenditures, property investment can be a low-risk option because the value of instrument flows in property is not sensitive and lower than investments such as stocks or crypto.

Stable market

Property investment has a stable flow and is not tight. According to Loan Market, this investment model has the potential to return on investment and is easier for investors.

Property Investment Losses

Apart from opportunities, property investment will still have challenges that must be faced during the course of this investment. So that this challenge also needs to be considered so that you can manage the process and risks in future plans. Therefore, the challenges that have the potential to occur and must be faced can be seen from the following list.

Big Capital

Starting a property investment even though it has a high opportunity and low risk, the capital prepared is large enough to own the property you want. It is possible that the property facilities obtained are inversely proportional to the capital you spend, even with a strategy and a large property value for the capital issued.

Expensive Treatment

Property maintenance costs require quite a large amount of capital because the shape of the property must still look attractive and have long-lasting properties such as leak resistance, no termites, and have an environment that attracts consumers.

Hard to Sell

If you are just starting to invest in property, don't expect to get occupants right away because the investment process is quite slow and quite difficult in marketing, when compared to stocks or crypto. Therefore, if you want liquidity quickly, such as an emergency fund need, then there is a possibility that the property's valuation can be lower than market quality.

https://www.detik.com/properti/tips-dan-panduan/d-6851831/untung-rugi-investasi-properti

Latest News