Singapore announces new property cooling measures: Higher ABSD rates, tighter loan limits

Writer: Ng Hong Siang

The Government on Wednesday (Dec 15) announced a package of measures to cool the private residential and HDB resale markets.

The measures include raising Additional Buyer’s Stamp Duty (ABSD) rates, tightening the Total Debt Servicing Ratio (TDSR) threshold and lowering the Loan-to-Value (LTV) limit for loans from the Housing and Development Board (HDB), said the Ministry of Finance, the Ministry of National Development and the Monetary Authority of Singapore in a joint press release.

"The Government has been closely monitoring the property market for several quarters," said the statement, which was released to the media just before 11.40pm. It added that the private residential and HDB resale markets have been buoyant, despite the economic impact of COVID-19.

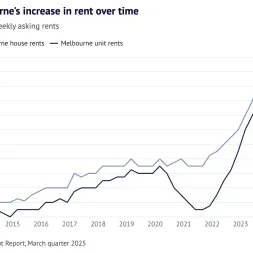

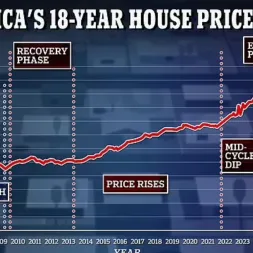

Private housing prices have risen by about 9 per cent since the first quarter of 2020.

HDB resale flat values have also risen by about 15 per cent since the same time, reversing a six-year decline, the authorities said.

"Even though House Price-to-Income ratios remain below their historical averages, there is clear upward momentum. Amid the low interest rate environment, transaction volumes in the private housing market and HDB resale market have also been high despite the COVID-19 situation.

"If left unchecked, prices could run ahead of economic fundamentals, and raise the risk of a destabilising correction later on. Borrowers would also be vulnerable to a possible rise in interest rates in the coming years."

To continue reading, please go to link below:

https://www.channelnewsasia.com/singapore/property-cooling-measures-absd-tdsr-ltv-loan-hdb-2382301

The Government on Wednesday (Dec 15) announced a package of measures to cool the private residential and HDB resale markets.

The measures include raising Additional Buyer’s Stamp Duty (ABSD) rates, tightening the Total Debt Servicing Ratio (TDSR) threshold and lowering the Loan-to-Value (LTV) limit for loans from the Housing and Development Board (HDB), said the Ministry of Finance, the Ministry of National Development and the Monetary Authority of Singapore in a joint press release.

"The Government has been closely monitoring the property market for several quarters," said the statement, which was released to the media just before 11.40pm. It added that the private residential and HDB resale markets have been buoyant, despite the economic impact of COVID-19.

Private housing prices have risen by about 9 per cent since the first quarter of 2020.

HDB resale flat values have also risen by about 15 per cent since the same time, reversing a six-year decline, the authorities said.

"Even though House Price-to-Income ratios remain below their historical averages, there is clear upward momentum. Amid the low interest rate environment, transaction volumes in the private housing market and HDB resale market have also been high despite the COVID-19 situation.

"If left unchecked, prices could run ahead of economic fundamentals, and raise the risk of a destabilising correction later on. Borrowers would also be vulnerable to a possible rise in interest rates in the coming years."

To continue reading, please go to link below:

https://www.channelnewsasia.com/singapore/property-cooling-measures-absd-tdsr-ltv-loan-hdb-2382301

Latest News