Singapore announces new property cooling measures, additional buyer's stamp duty doubled to 60% for foreigners

SINGAPORE: Foreigners buying any residential property in Singapore from Thursday (Apr 27) will have to pay an additional buyer’s stamp duty (ABSD) of 60 per cent after it was doubled from 30 per cent.

This was the steepest increase among the cooling measures the government announced late on Wednesday night.

Singaporeans buying their second residential property will pay an ABSD rate of 20 per cent, up from 17 per cent, while those buying their third and subsequent residential property will have to pay an increased rate of 30 per cent, up from 25 per cent.

The rate of 30 per cent also applies to permanent residents buying their second residential property. PRs buying their third and subsequent residential property will pay an ABSD of 35 per cent, up from 30 per cent.

This is the third round of cooling measures since December 2021.

The increases in ABSD are to "promote a sustainable property market and prioritise housing for owner-occupation", said the Ministry of Finance (MOF), the Ministry of National Development (MND) and the Monetary Authority of Singapore (MAS) in a joint statement on Wednesday night.

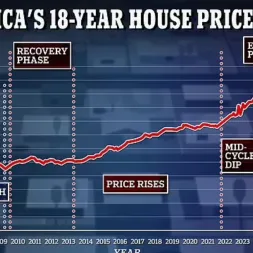

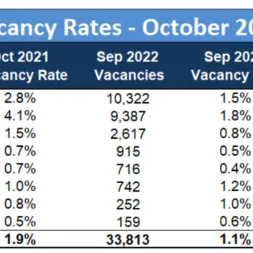

They noted that the earlier measures in December 2021 and September 2022 have had a "moderating effect". However, property prices in the first quarter of 2023 showed "renewed signs of acceleration amid resilient demand".

“Demand from locals purchasing homes for owner-occupation has been especially strong, and there has also been renewed interest from local and foreign investors in our residential property market," said the authorities.

"If left unchecked, prices could run ahead of economic fundamentals, with the risk of a sustained increase in prices relative to incomes.”

Based on 2022 data, the ABSD rate increases will affect about 10 per cent of residential property transactions.

The ABSD rates for Singapore citizens and permanent residents purchasing their first residential property - which constitutes about 90 per cent of residential property transactions based on 2022 data - will remain at 0 per cent and 5 per cent respectively.

For acquisitions made jointly by two or more parties of different profiles, MOF, MND and MAS said the highest applicable ABSD rate will apply.

Married couples with at least one Singaporean spouse, who jointly purchase a second residential property, can continue to apply for a refund of ABSD, subject to conditions.

These conditions include selling their first residential property within six months after the date of purchase of the second residential property if it is a completed property, or the issue date of the Temporary Occupation Permit (TOP) or Certificate of Statutory Completion (CSC) of the second residential property, whichever is earlier, if the second property is not completed at the time of purchase.

The ABSD currently does not affect those buying a Housing and Development Board (HDB) flat or executive condominium unit from housing developers with an upfront remission, if any of the joint acquirers or purchasers is a Singapore citizen. There will be no change to this policy.

Please keep reading on:

https://www.channelnewsasia.com/singapore/property-cooling-measures-absd-additional-buyers-stamp-duty-doubled-foreigners-increase-3446376

This was the steepest increase among the cooling measures the government announced late on Wednesday night.

Singaporeans buying their second residential property will pay an ABSD rate of 20 per cent, up from 17 per cent, while those buying their third and subsequent residential property will have to pay an increased rate of 30 per cent, up from 25 per cent.

The rate of 30 per cent also applies to permanent residents buying their second residential property. PRs buying their third and subsequent residential property will pay an ABSD of 35 per cent, up from 30 per cent.

This is the third round of cooling measures since December 2021.

The increases in ABSD are to "promote a sustainable property market and prioritise housing for owner-occupation", said the Ministry of Finance (MOF), the Ministry of National Development (MND) and the Monetary Authority of Singapore (MAS) in a joint statement on Wednesday night.

They noted that the earlier measures in December 2021 and September 2022 have had a "moderating effect". However, property prices in the first quarter of 2023 showed "renewed signs of acceleration amid resilient demand".

“Demand from locals purchasing homes for owner-occupation has been especially strong, and there has also been renewed interest from local and foreign investors in our residential property market," said the authorities.

"If left unchecked, prices could run ahead of economic fundamentals, with the risk of a sustained increase in prices relative to incomes.”

Based on 2022 data, the ABSD rate increases will affect about 10 per cent of residential property transactions.

The ABSD rates for Singapore citizens and permanent residents purchasing their first residential property - which constitutes about 90 per cent of residential property transactions based on 2022 data - will remain at 0 per cent and 5 per cent respectively.

For acquisitions made jointly by two or more parties of different profiles, MOF, MND and MAS said the highest applicable ABSD rate will apply.

Married couples with at least one Singaporean spouse, who jointly purchase a second residential property, can continue to apply for a refund of ABSD, subject to conditions.

These conditions include selling their first residential property within six months after the date of purchase of the second residential property if it is a completed property, or the issue date of the Temporary Occupation Permit (TOP) or Certificate of Statutory Completion (CSC) of the second residential property, whichever is earlier, if the second property is not completed at the time of purchase.

The ABSD currently does not affect those buying a Housing and Development Board (HDB) flat or executive condominium unit from housing developers with an upfront remission, if any of the joint acquirers or purchasers is a Singapore citizen. There will be no change to this policy.

Please keep reading on:

https://www.channelnewsasia.com/singapore/property-cooling-measures-absd-additional-buyers-stamp-duty-doubled-foreigners-increase-3446376

Latest News