Labor refuses to rule out negative gearing changes as Treasury reportedly studies housing tax

Anthony Albanese declares public service is ‘looking at policy ideas’ as report raises prospect Labor is investigating shift on housing tax concessions

Anthony Albanese has repeatedly declined to confirm or deny whether the federal government is considering changes to negative gearing, but conceded that public servants “do a range of proposals” on potential ideas.

The Nine newspapers reported on Wednesday that the government had asked Treasury to model potential changes to negative gearing concessions. The government has come under pressure from the Greens and crossbench to make changes to the property investment tax breaks, amid speculation that Labor could consider making a bold change as part of their re-election bid.

“I’m sure the public service are looking at policy ideas. That’s because we value them. But we have our housing policy. It’s out there for all to see,” Albanese said in Tasmania when asked about the report.

“What our government is considering is fixing housing supply by getting our legislation through the Senate. That’s what we’re considering … I talk about what we’re doing, not what we’re not doing.”

Negative gearing is a tax concession where investors can deduct losses from investment properties – that is, if their expenses are higher than any rent derived from the home – from their other taxable income, reducing their tax bill.

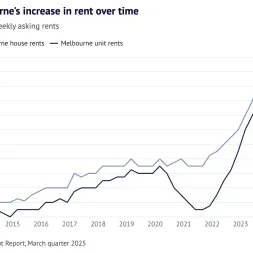

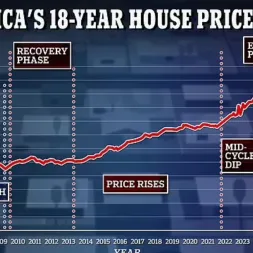

It has become a totemic policy in Australian politics, blamed by critics for raising housing prices but backed by supporters as an important setting for financial investments and rental supply.

Parliamentary Budget Office analysis, commissioned by the Greens, found tax breaks given to residential property investors will cost more than $165bn over the next decade. The Greens have been pressuring the government to wind back negative gearing concessions for people with multiple homes as part of its housing package; but following major political attacks on proposed negative gearing changes at the 2019 election, Labor has been reticent to consider such reforms.

To continue reading, please click link below:

https://www.theguardian.com/australia-news/2024/sep/25/negative-gearing-house-tax-reform-treasury-modelling

Anthony Albanese has repeatedly declined to confirm or deny whether the federal government is considering changes to negative gearing, but conceded that public servants “do a range of proposals” on potential ideas.

The Nine newspapers reported on Wednesday that the government had asked Treasury to model potential changes to negative gearing concessions. The government has come under pressure from the Greens and crossbench to make changes to the property investment tax breaks, amid speculation that Labor could consider making a bold change as part of their re-election bid.

“I’m sure the public service are looking at policy ideas. That’s because we value them. But we have our housing policy. It’s out there for all to see,” Albanese said in Tasmania when asked about the report.

“What our government is considering is fixing housing supply by getting our legislation through the Senate. That’s what we’re considering … I talk about what we’re doing, not what we’re not doing.”

Negative gearing is a tax concession where investors can deduct losses from investment properties – that is, if their expenses are higher than any rent derived from the home – from their other taxable income, reducing their tax bill.

It has become a totemic policy in Australian politics, blamed by critics for raising housing prices but backed by supporters as an important setting for financial investments and rental supply.

Parliamentary Budget Office analysis, commissioned by the Greens, found tax breaks given to residential property investors will cost more than $165bn over the next decade. The Greens have been pressuring the government to wind back negative gearing concessions for people with multiple homes as part of its housing package; but following major political attacks on proposed negative gearing changes at the 2019 election, Labor has been reticent to consider such reforms.

To continue reading, please click link below:

https://www.theguardian.com/australia-news/2024/sep/25/negative-gearing-house-tax-reform-treasury-modelling

Latest News