Fill in the 2024 Tax Return Automatically? Here's the explanation

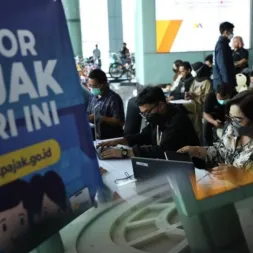

Jakarta CNBC Indonesia - Taxpayers will no longer experience the hassle of filling out an Annual Tax Return (SPT) starting in 2025. This is because filling out the SPT for the 2024 tax year will be more practical.

Taxpayers, both individual taxpayers and business entities, no longer need to enter tax data one by one and calculate it themselves. The Directorate General of Taxes (DJP) system will allow taxpayers to obtain prepopulated SPT or SPT with data presented automatically.

This sophisticated system developed by DGT is the core tax system or the Renewal of the Tax Administration Core System (PSIAP). Through the core tax system, taxpayers will gain access to tax payer accounts which contain tax liability data, starting from SPT to asset data and other tax transactions.

Meanwhile, prepopulated taxpayer data is drawn from various agencies including banking, local government, customs, BKPM and other institutions. DGT will partner with 89 entities to integrate their systems with the core system.

Expert Staff to the Minister of Finance for Tax Regulations and Law Enforcement, Iwan Djuniardi, explained that the concept of prepopulated SPT will be visible from the withholding receipts that are released. If the proof of withholding data is correct, please confirm and submit the tax directly.

"If it's true, just 'yes..yes..yes', if it's not true, just fix it," he told CNBC Indonesia, quoted Tuesday (8/8/2023).

However, if there are other incomes that have not been listed, Iwan emphasized that taxpayers must report this.

"It's not filled in by the tax office, as if it were the DJP. Because there is other income data, for example shop data and others, we haven't taken it. We haven't taken the underground data," stressed Iwan.

If the core tax is running, Iwan said that some data will be included in the SPT. For example, the tax on house rent or boarding house rent.

"In the past, it wasn't included, even though the tax was 10%," he said. So far, everything depends on honesty. In the new system, DGT can look through the taxpayer's assets.

"How come this asset is silent. We can calculate the cost of the asset. Or maybe this asset is rented out," he said. All of this data will be entered into the taxpayer's tax payer account which is loaded in the core tax system and can be seen by the taxpayer. If there is an error in asset data, Iwan said that taxpayers can contact the tax office.

"There is a call center, but there must be evidence," he stressed.

The plan is that this system will start running fully on May 1 2024. Currently, this sophisticated system is still undergoing testing. The Directorate General of Taxes must ensure that the modules of the 21 business functions in the core tax system run well and correctly.

"The modules were tested, there were things that weren't justified. Now it's just per module. We're starting to test whether there are any missing functions. This is still being enriched," he explained.

After the enrichment phase, then enter the integrated testing system. This was done in order to connect 21 modules that had been tested previously.

Iwan ensures that this phase also takes a long time. Meanwhile, 21 tax service business processes have been processed from manual to automatic based on technology, namely. management of Tax Returns (SPT), document management system (DMS), taxpayer services, assessment services, supervision, extensification, tax collection, investigations, objections and appeals.

https://www.cnbcindonesia.com/news/20230808054749-4-460967/isi-spt-pajak-2024-automat-begini-pengjualannya

Taxpayers, both individual taxpayers and business entities, no longer need to enter tax data one by one and calculate it themselves. The Directorate General of Taxes (DJP) system will allow taxpayers to obtain prepopulated SPT or SPT with data presented automatically.

This sophisticated system developed by DGT is the core tax system or the Renewal of the Tax Administration Core System (PSIAP). Through the core tax system, taxpayers will gain access to tax payer accounts which contain tax liability data, starting from SPT to asset data and other tax transactions.

Meanwhile, prepopulated taxpayer data is drawn from various agencies including banking, local government, customs, BKPM and other institutions. DGT will partner with 89 entities to integrate their systems with the core system.

Expert Staff to the Minister of Finance for Tax Regulations and Law Enforcement, Iwan Djuniardi, explained that the concept of prepopulated SPT will be visible from the withholding receipts that are released. If the proof of withholding data is correct, please confirm and submit the tax directly.

"If it's true, just 'yes..yes..yes', if it's not true, just fix it," he told CNBC Indonesia, quoted Tuesday (8/8/2023).

However, if there are other incomes that have not been listed, Iwan emphasized that taxpayers must report this.

"It's not filled in by the tax office, as if it were the DJP. Because there is other income data, for example shop data and others, we haven't taken it. We haven't taken the underground data," stressed Iwan.

If the core tax is running, Iwan said that some data will be included in the SPT. For example, the tax on house rent or boarding house rent.

"In the past, it wasn't included, even though the tax was 10%," he said. So far, everything depends on honesty. In the new system, DGT can look through the taxpayer's assets.

"How come this asset is silent. We can calculate the cost of the asset. Or maybe this asset is rented out," he said. All of this data will be entered into the taxpayer's tax payer account which is loaded in the core tax system and can be seen by the taxpayer. If there is an error in asset data, Iwan said that taxpayers can contact the tax office.

"There is a call center, but there must be evidence," he stressed.

The plan is that this system will start running fully on May 1 2024. Currently, this sophisticated system is still undergoing testing. The Directorate General of Taxes must ensure that the modules of the 21 business functions in the core tax system run well and correctly.

"The modules were tested, there were things that weren't justified. Now it's just per module. We're starting to test whether there are any missing functions. This is still being enriched," he explained.

After the enrichment phase, then enter the integrated testing system. This was done in order to connect 21 modules that had been tested previously.

Iwan ensures that this phase also takes a long time. Meanwhile, 21 tax service business processes have been processed from manual to automatic based on technology, namely. management of Tax Returns (SPT), document management system (DMS), taxpayer services, assessment services, supervision, extensification, tax collection, investigations, objections and appeals.

https://www.cnbcindonesia.com/news/20230808054749-4-460967/isi-spt-pajak-2024-automat-begini-pengjualannya

Latest News