Hit by Recession Issues, Australian Dollar Drops to IDR 10,000!

Jakarta, CNBC Indonesia - The Australian Dollar exchange rate fell against the rupiah earlier this week and continued on Tuesday (12/7/2022) morning trading. The Australian dollar is now back in the range of IDR 10,000/AU$.

According to data from Refinitiv, the Australian dollar this morning fell 0.25% to Rp 10,049/AU$ in the spot market, while yesterday it fell 1.9%.

Some areas of China that are back in lockdown are making the Australian dollar. China is Australia's main export market, so this policy could result in a decline in demand.

Several cities in China did so because of the occurrence of the Corona virus (Coronavirus Disease-2019/Covid-19). Restrictions from business shutdowns to lockdowns with the aim of controlling new infections.

Plus the Shanghai commercial center is preparing to carry out another mass test after detecting the BA.5 Omicron sub-variant.

China's return to lockdown has made the outlook for the Australian economy even more bleak, and the risk of a recession getting bigger.

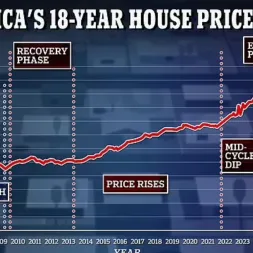

Australia is one of the countries that is expected to suffer as a result of rising inflation, as well as the policy of its central bank (Reserve Bank of Australia/RBA) which raises interest rates.

"Many central banks today have essentially singled out mandates, namely lowering inflation. Policy credibility is a very valuable asset that should not be lost, so the central bank will increase interest rates," said Rob Subbraman, Nomura's chief economist at a Street event. Sign Asia CNBC International, Tuesday (5/7/2022).

Subbraman projects that in the next 12 months the euro zone, Britain, Japan, Australia, Canada and South Korea will also experience a recession.

"Aggressive rate hikes mean we're seeing a front loading policy. In the past few months we've seen the risk of a recession, and now some developed countries are actually falling into recession," Subbraman added.

The RBA under Philip Lowe's monetary policy announcement today raised interest rates by 50 basis points to 1.35%.

Thus, the RBA has raised interest rates for 3 months in a row, and is at the highest point since May 2019, or before the coronavirus disease (Covid-19) pandemic.

When interest rates rise, the business world will restrain its expansion due to higher lending rates, as well as people who delay consumption. This will have an impact on the economic slowdown, up to a recession.

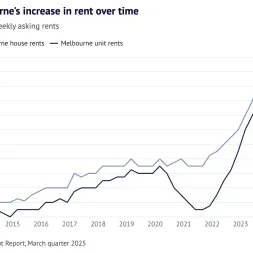

Diana Mousina, senior economist at AMP Australia also said an increase in interest rates will have an impact on housing prices, consumer spending and housing investment which can suppress consumer confidence levels.

As a result, the risk of a recession is getting bigger.

https://www.cnbcindonesia.com/market/20220712100630-17-354866/dihantam-isu-resesi-dolar-australia-jeblok-ke-rp-10000

According to data from Refinitiv, the Australian dollar this morning fell 0.25% to Rp 10,049/AU$ in the spot market, while yesterday it fell 1.9%.

Some areas of China that are back in lockdown are making the Australian dollar. China is Australia's main export market, so this policy could result in a decline in demand.

Several cities in China did so because of the occurrence of the Corona virus (Coronavirus Disease-2019/Covid-19). Restrictions from business shutdowns to lockdowns with the aim of controlling new infections.

Plus the Shanghai commercial center is preparing to carry out another mass test after detecting the BA.5 Omicron sub-variant.

China's return to lockdown has made the outlook for the Australian economy even more bleak, and the risk of a recession getting bigger.

Australia is one of the countries that is expected to suffer as a result of rising inflation, as well as the policy of its central bank (Reserve Bank of Australia/RBA) which raises interest rates.

"Many central banks today have essentially singled out mandates, namely lowering inflation. Policy credibility is a very valuable asset that should not be lost, so the central bank will increase interest rates," said Rob Subbraman, Nomura's chief economist at a Street event. Sign Asia CNBC International, Tuesday (5/7/2022).

Subbraman projects that in the next 12 months the euro zone, Britain, Japan, Australia, Canada and South Korea will also experience a recession.

"Aggressive rate hikes mean we're seeing a front loading policy. In the past few months we've seen the risk of a recession, and now some developed countries are actually falling into recession," Subbraman added.

The RBA under Philip Lowe's monetary policy announcement today raised interest rates by 50 basis points to 1.35%.

Thus, the RBA has raised interest rates for 3 months in a row, and is at the highest point since May 2019, or before the coronavirus disease (Covid-19) pandemic.

When interest rates rise, the business world will restrain its expansion due to higher lending rates, as well as people who delay consumption. This will have an impact on the economic slowdown, up to a recession.

Diana Mousina, senior economist at AMP Australia also said an increase in interest rates will have an impact on housing prices, consumer spending and housing investment which can suppress consumer confidence levels.

As a result, the risk of a recession is getting bigger.

https://www.cnbcindonesia.com/market/20220712100630-17-354866/dihantam-isu-resesi-dolar-australia-jeblok-ke-rp-10000

Latest News