Change BI Checking, Here's How to Check Credit Online

Jakarta, CNBC Indonesia - The BI checking service (SID) has changed to the Financial Information Service System (SLIK). The service was transferred from Bank Indonesia to the Financial Services Authority.

BI Checking is a credit history information service for the Debtor Information System (SID) regarding customer loans exchanged between banks and financial institutions. This is one of the conditions for applying for bank loans, such as Home Ownership Loans (KPR), Unsecured Loans (KTA) or credit cards.

The SID contains information on the identity of the debtor's collateral, the owner and management of the business entity that is the debtor, the amount of financing received, the debtor's credit history, and information about bad credit. For debtors who have not paid off the loan or have problems in arrears on loan installments, their data will be included in the BI checking blacklist and cannot apply for a loan.

For SLIK, it contains information on the credit history of banking and financing customers, as well as other finance, which is referred to as a debtor information service (iDEB). Banking, financing and financial institutions have access to debtor data.

This information is publicly viewable. Here are the terms and how to check it:

1. Terms of Access to BI Checking SLIK

Prepare original identity cards, namely ID cards for Indonesian citizens and passports for foreigners for individual debtors. Meanwhile, business entity debtors are required to bring a photocopy of the identity of the business entity and the identity of the management by submitting the original identity of the business entity.

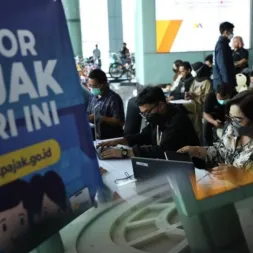

Visit the OJK office in Jakarta or OJK representative offices in the regions.

Fill out the SID application form.

If the documents are complete, the OJK officer will print the iDEB results.

2. How to Check BI Checking or SLIK Online

Open the link for the SLIK application consumer.ojk.go.id/minisitedplk/registration.

Fill out the form and fill in the queue number.

Please upload scanned photos of the required documents (KTP, Passport, NPWP, Company Establishment Deed, Management Identity).

Fill in the captcha fields and click the Submit button.

Wait for a confirmation email from the OJK containing proof of registration for the SLIK Online queue.

OJK will verify the data and the applicant will receive notification from OJK in the form of online SLIK queue verification results no later than D-2 from the queue date.

If the data submitted is valid, the customer can print the form and sign it 3 times.

Photo or scan of the signed form.

Then send it to the WhatsApp number listed in the email (complete with a selfie holding a KTP).

OJK will verify data via WA and make video calls if necessary.

If passed, OJK will send iDEB SLIK results via email.